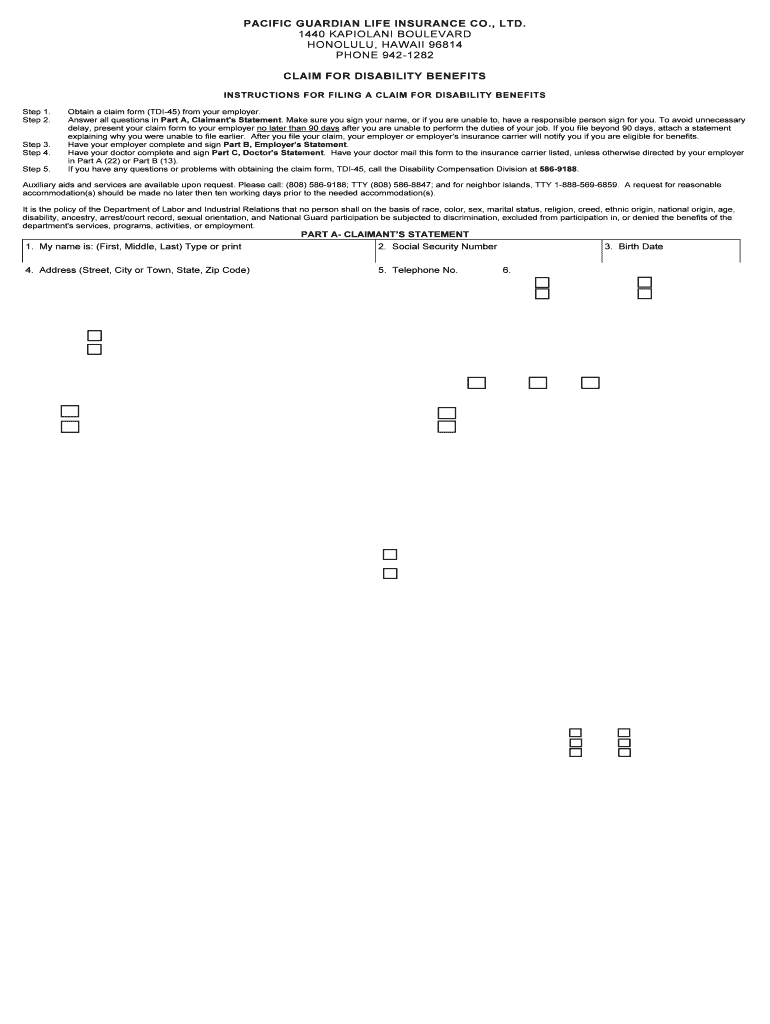

Pacific Guardian Life TDI-45 2002-2025 free printable template

Get, Create, Make and Sign pacific guardian tdi form

How to edit pacific guardian life tdi form online

How to fill out tdi form hawaii

How to fill out Pacific Guardian Life TDI-45

Who needs Pacific Guardian Life TDI-45?

Video instructions and help with filling out and completing pacific tdi form

Instructions and Help about form tdi 45 hawaii pdf

APA RNA MATHER: Thank you, everyone, all of you in the room and those who are watching online for joining us for an important conversation today about paid family leave and gender pay inequity in the United States. I’m Apart Mather, and I’m a resident scholar here in economic policy studies at AEI. The reason we’redoing — you know, starting this conversation is that if you look at the labor force participation rates for women, they have increased significantly over the last few decades, but data suggests that participation rates for women vary significantly over their life cycle. According to data from the Bureau of Labor Statistics, there is actually a 10 percentage point gap between the participation rates for women and men in their prime working age years, so in the 30s and 40s. If you look at what’s happening to labor force participation for women, you know, men are 10 to 15 percentage points more likely to be in the labor market. They’re much more likely to be in full-time jobs than women. In fact, the surprising thing is that a lot of women in the ages of 25 to 54 are actually — 50 percent of them are in part-time jobs. And I think that speaks a lot about, you know, their lifetime incomes, their careers, their ability to achieve and attain their true potential. And the reason I think that we are seeing a lot of labor force dropouts at these ages is because women tend to have, you know, family responsibilities. A lot of this happens at the time of birth of a child, when a lot of women drop out of the labor force entirely. It could happen because they don’t have systems of paid leave which allow them to take six to eight weeks off from work with job security, with a guaranteed pay and the ability to get back to the same job. And it also suggests that the cost of childcare are really high as a result of which a lot of women then decide, well, I’m not going to be able to go back to work because I need to look after, you know, the child at home. It’s too expensive to put them in a daycare. So these kinds of transitions in and out of the labor market really affect the types of jobs that women are able to take, which affects the women’s earnings over their lifetime. So how do we make the American workplace more accepting of these challenges faced by women in particular and working families as a whole? We’re extremely pleased to welcome Senator Fischer, who will discuss the proposals for addressing these issues. She will take a few questions after her talk, and then we will move on to a panel discussion. So I want to begin by inviting Senator Fischer to give her remarks. Thank you so much. (Applause.) SENATOR DEB FISCHER (R-NE): Thank you very much. It is a pleasure to be here with you today, and I’m excited to be here at AEI. This is an important institution not only to protect free enterprise, but it also I believe fosters very thoughtful debate. And today’s program I think will continue that strong tradition. I’m here today to talk about two...

People Also Ask about tdi form hawaii pdf

How does TDI work for maternity leave in Hawaii?

What is the maximum weekly benefit for TDI in Hawaii 2023?

How much does temporary disability pay in Hawaii?

Does employer pay TDI in Hawaii?

Who qualifies for TDI in Hawaii?

How much do you get for TDI in Hawaii?

How much percent does TDI pay in Hawaii?

How long is TDI for pregnancy in Hawaii?

What is the TDI rate in Hawaii 2023?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pacific guardian life tdi?

How to fill out pacific guardian life tdi?

What is the purpose of pacific guardian life tdi?

What information must be reported on pacific guardian life tdi?

How do I edit pacific guardian life tdi claim form in Chrome?

Can I create an electronic signature for the tdi 45 claim form in Chrome?

How do I complete tdi 45 pdf on an Android device?

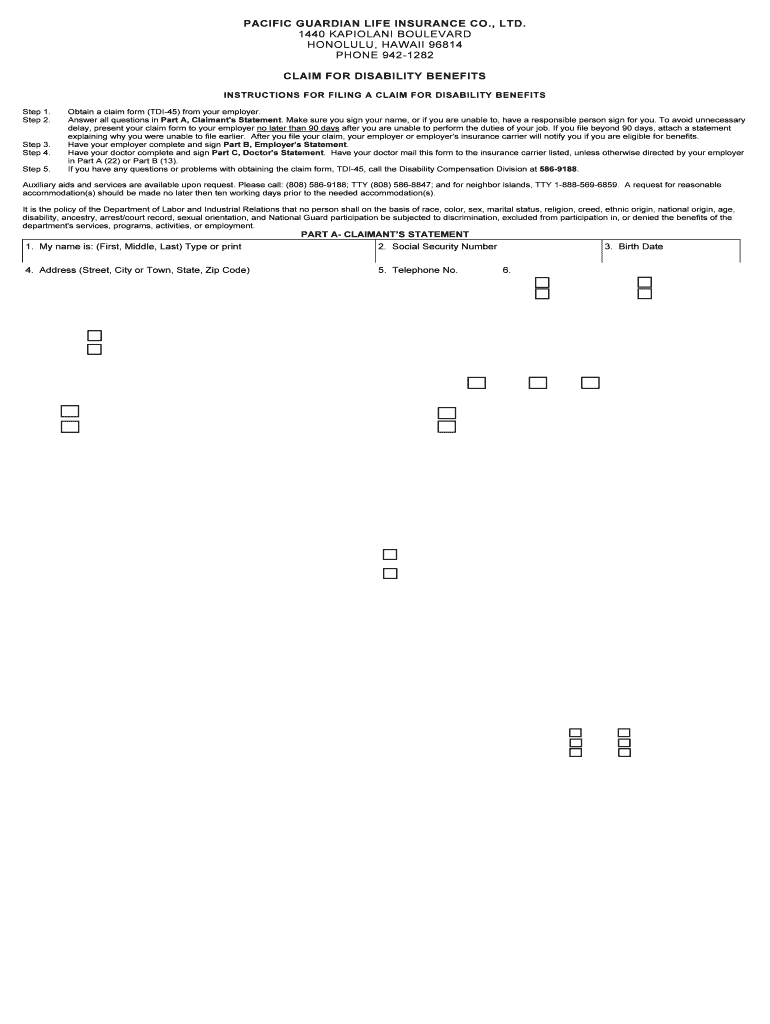

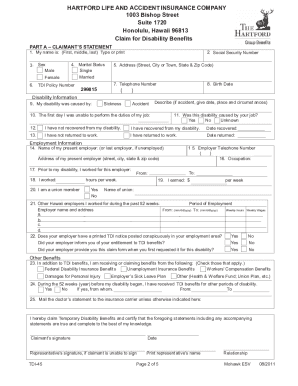

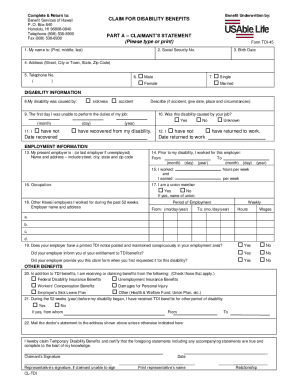

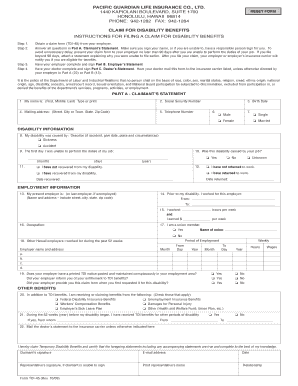

What is Pacific Guardian Life TDI-45?

Who is required to file Pacific Guardian Life TDI-45?

How to fill out Pacific Guardian Life TDI-45?

What is the purpose of Pacific Guardian Life TDI-45?

What information must be reported on Pacific Guardian Life TDI-45?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.